Turning Africa into a source of carbon credits will benefit polluters and middlemen, not the majority of Africans and not the planet

There is increasing hype and push for so-called voluntary carbon trading in Africa.

Politicians, businesses, other NGOs and large philanthropies are trying to get the African Carbon Market Initiative off the ground, which will allow companies to buy carbon credits in exchange for continued emissions.

It is a central issue in the run-up to the African Climate Summit this month. But African leaders should think twice before supporting this wolf in sheep’s clothing.

The idea is that some of the money paid by corporations in these “carbon credits” – or more precisely, pollution permits – will go to African projects that prevent or reduce emissions: renewable energy projects, or targeted land and environmental schemes. to capture carbon from the atmosphere.

But many key questions are being ignored – are they working for Africans, climate and development?

Features of the UAE itself as Africa’s leader in carbon credits

For western polluters, they are the silver bullet pain reliever that allows them to keep pumping greenhouse gases into the atmosphere. But in Africa, they are a placebo medicine that only makes the pain of climate change worse.

Africa is right to seek climate finance in the global north, which has caused the climate crisis that is ravaging African people, economies, and the environment in the first place.

But instead of signing up for a carbon market initiative full of booby traps, African leaders should use this opportunity to work with others in the global south to ask where the most important money and the most important part of the important role we play in protecting forests. and nature, without which the Paris Agreement will fail?

Where is the money for the actions to reduce emissions and adapt to climate change that we need and deserve?

The leaders of Africa over fossil fuels in the climate summit announcement

A series of summits – the Amazon Summit last month, the African Climate Summit, the Three-Party Summit, and Cop28 – offer real opportunities for Southern leaders to advance funding options that aren’t just designed to cover big polluters.

African leaders have three serious questions to ask about the African Carbon Market Initiative.

First: is this cutting pollution, or allowing it? For global businesses, buying credits is the cheapest way to avoid real cuts and continue business as usual.

Take Delta Airlines: they claim to be carbon neutral, in part to buying tens of millions of carbon credits each year. Meanwhile, they continue to operate 4,000 flights a day.

Calculations like this depend on the argument that a ton of carbon emitted is equal to a ton of carbon sequestered, or captured in forests or agricultural land. This is wrong.

What are the climate advocates should learn from wind energy problems in Kenya

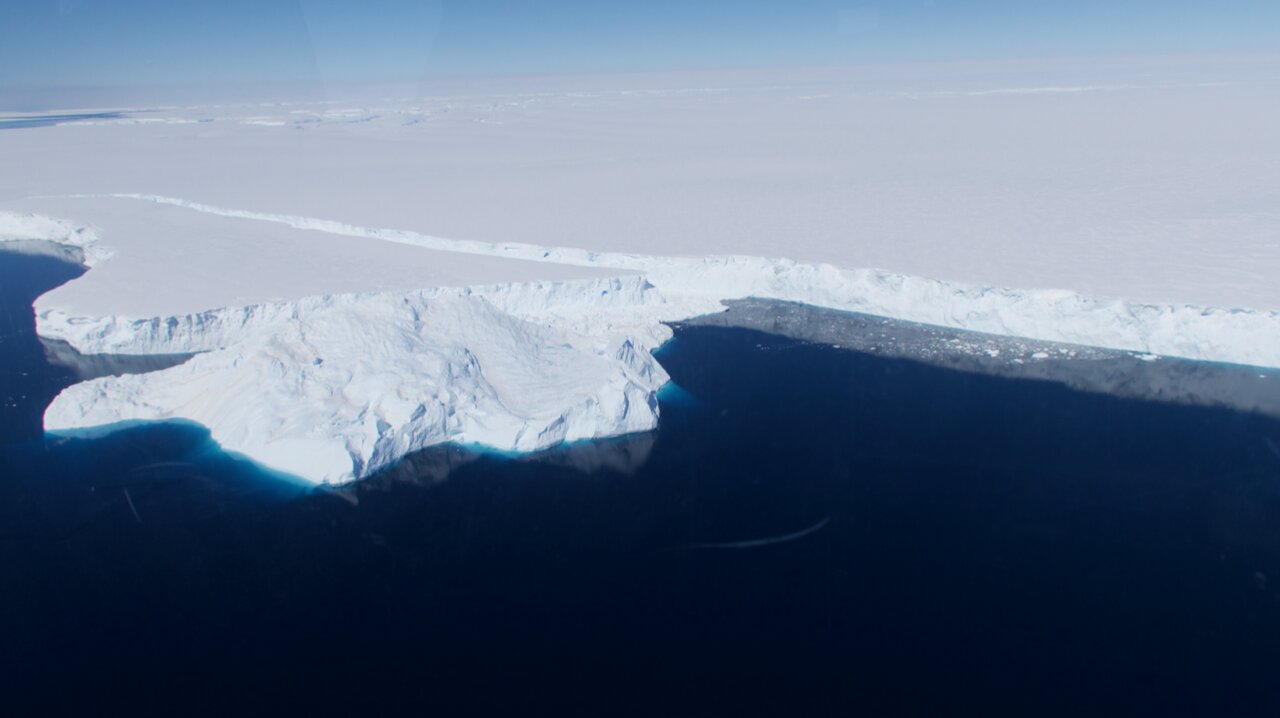

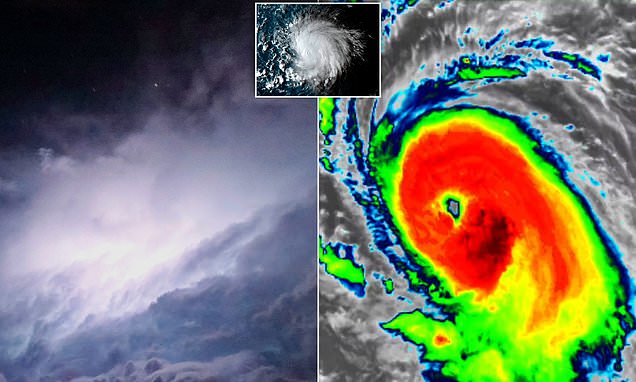

Fossil fuel emissions are permanent, but keeping carbon in the environment is fragile: forests burn, loggers move in, and carbon goes out again. That means a very hot world: and in Africa, especially droughts, floods and destructive storms.

The second question African leaders must ask: when we follow the money, who wins? Two players benefit from carbon markets more than anyone else: fossil fuel companies, and financial traders who buy and sell credits at huge markups.

Fossil fuel giants see their production as legal, because polluters can keep burning it by buying pollution permits.

Carbon credit traders are on the way to making huge profits too: one study found that some traders sell credits for three times the price they pay for the project they create.

Southeast Asia it must not allow Japan to take its power transition

Since they make a profit from every trade, they are incentivized to create, trade and speculate on as many carbon credits as possible – so a market claiming to be worth $100 could be due to one $10 credit being traded ten times. African countries will be greatly disappointed if their output is far below the promised market value.

The third question leaders must answer: Will carbon markets promote development? What do Africans gain from this? It will not be the money they deserve: the moneylenders siphon off a lot of money before it reaches African projects. And the promises of economic development by the African Carbon Markets Initiative depend on exaggerated claims of creating jobs and income.

Indeed, since carbon markets were introduced more than two decades ago, initially through the Kyoto Protocol, there is considerable evidence that carbon emission schemes mean insecurity and land dispossession.

‘Carbon Bomb’ Argentina is getting a push from the local government

Planting new forests requires land, as well as floodplains for new power projects.

In the Democratic Republic of the Congo, families were evicted from the land they owned and farmed for generations to make way for oil giant Total Energies’ decarbonisation project.

Similar stories are spreading in countries, such as Colombia, with similar experiences. This is why indigenous peoples of South America spoke out against carbon markets at Cop26.

Instead, Africa needs to consider discussions on how to finance our response to the climate crisis.

Much is at stake: Africa’s adaptation costs and the costs of the clean energy transition and other measures to build zero-carbon societies will reach hundreds of billions of dollars annually for decades to come.

The US denies it embezzling losses and damages from the fund board in favor of wealthy nations

We cannot afford to lock ourselves into the barriers of false and ineffective carbon sales.

Africa is blessed with world-leading talent, the planet’s best resources for wind, solar, biodiversity and geothermal energy, and the ability to leapfrog other continents into future technologies.

We need to consider a new way of funding “polluter pays”, where polluting industries will pay to reduce emissions and adapt to climate change, where Africa defines its needs.

The amount they pay will increase over time, encouraging companies to stay within the limits of the Paris Agreement.

This money will increase the capacity of Africans for clean, sustainable and affordable development led by local communities. It will remove the market sellers and middlemen and increase the investment in the projects.

We need a debt cancellation plan, more domestic investment in renewables, an end to fossil fuel subsidies and investments, and a fair share of climate finance in Africa. Africa cannot offer another false solution to the climate crisis.

Mohammed Adow is the founding director of Power Shift AfricaA Nairobi-based climate change and energy think tank.

#African #Carbon #Markets #Initiative #Wolf #Sheeps #Clothing